Security as a service market global forecast to 2025 by Marketsandmarkets.com includes Solution and Service, Application Area (Network Security, Endpoint Security, Application Security, and Cloud), Organization Size, Industry (Vertical in the report), and Region.

The global security as a service market size is forecasted to mature from USD 11.1 billion in 2020 to USD 26.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 18.9%.

The key factors affecting the growth of the security market as a service: mandatory compliance and data protection laws, the high cost of on-premises security solutions, and associated risks, as well as the growing demand for cloud-based security solutions.

The COVID-19 pandemic and its impact on the security as a service market

Due to the COVID-19 pandemic crisis state and private organizations have been obliged by governments and regulatory bodies to introduce and implement working from home policies and to prove they are complying with social distancing rules. So far digital adoption and transformation has been shaping entirely new ways of doing business and has become the new Business Continuity Plan (BCP.)

Companies, which are seeking large contracts, including the deals in regulated and critical sectors are required to ensure business continuity planning (BCP) and build up their cyber resilience level.

In the new environment, organizations are also using new approaches and solutions to optimize workflows: work from home (WFH) and bring your own device (BYOD.)

Thanks to the crisis of COVID-19 both company executives and boards have changed their attitude towards cybersecurity. Moreover, it was not technology giants, but small and medium-sized enterprises, startups, and large companies that approached cybersecurity budgets as unavoidable capital expenditures (CAPEX) to comply with various requirements.

During the pandemic companies faced the problem of ensuring the security of their networks, given the fact that employees work remotely either on office laptops with zero protection (not being behind a firewall) or on personal laptops with free antivirus software or without it at all.

Key Driver – Compliance and Data Protection Laws

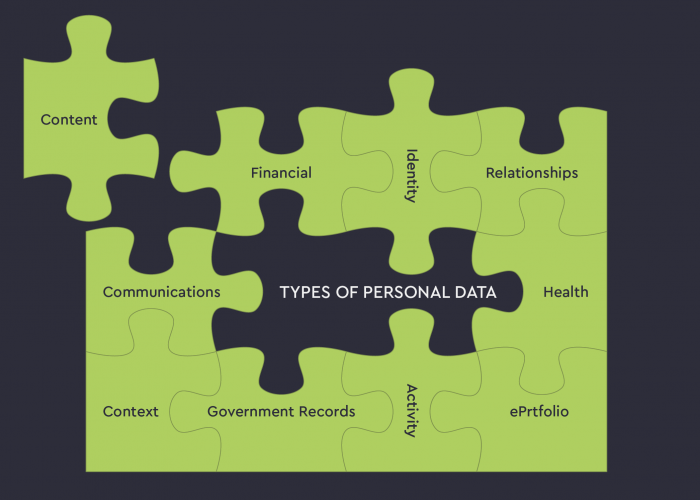

Over time organizations have been suffering from many complex cyberattacks, resulting in financial losses. As of now, organizations are looking for cutting-edge cybersecurity solutions to tackle such devastating attacks. When introducing such solutions, compliance with acting data protection laws is a must-have.

Data protection laws make a big difference in addressing the growing concerns of enterprise data privacy. This is an ever-changing threat landscape that has fostered the government regulations of data protection issues around the world.

Enterprises are required to conform to mandatory safety standards, otherwise, they are doomed to pay big fines to authorities. On top of that breaches or data leakage worsen the reputation of companies.

There are the following common requirements: Payment Card Industry Data Security Standard (PCI DSS), Health Insurance Portability and Accountability Act

(HIPAA), Federal Information Security Management Act (FISMA), Gramm-Leach-Bliley Act (GLBA), General Regulation Data Protection Act (GDPR), and Homeland Security Act (HSA).

Stumbling block: Availability of free security services

Cloud service providers offer security as a service to organizations to manage their expanding infrastructure and resources and to reduce their costs. Various suppliers offer a wide range of cybersecurity solutions at reduced prices and sometimes bundled services for free. This is one of the issues preventing the growth of security service providers who provide security as a service to end-users.

Performing similar tasks, security products, and services are available at low prices through widespread distribution networks, thus holding back the growth of the security as a service market.

Opportunity: Transitioning SMEs to Cloud Services

Small and medium-sized businesses are constantly working at fine-tuning their business models to increase efficiency. SMEs do not have strict security measures to protect their data, networks, endpoints, and applications. Therefore, they are often targeted by cybercriminals. These enterprises do not use advanced cybersecurity solutions to counter growing cyber threats yet.

Traditional security systems are easily bypassed by sophisticated cyberattacks. Therefore, SMEs need to move from traditional cybersecurity solutions to cloud cybersecurity solutions to protect their web and mobile applications, as well as their network infrastructure. The SMEs moving to cloud solutions will bring about huge growth opportunities to cloud-based data protection solution and service providers.

Challenge: IT Infrastructure Becomes More Complex

Due to the changing business process needs the IT infrastructure of organizations is becoming more manageable. Organizations face risk management challenges including cyber risks, ongoing monitoring, and troubleshooting of IT infrastructure.

Business applications have several identities, rules, and other processes that pose difficulties for cloud-based security solutions to provide efficiency, security, and compliance.

Today, IT infrastructures face various cyberthreats, such as antivirus, malware, APT, and zero-day vulnerabilities. Incompatibility with existing IT systems is expected to be a major concern for security providers as a service.

Security services segment to reach the highest CAGR

The Security as a service includes business continuity and disaster recovery, continuous monitoring, Data Loss Prevention (DLP), encryption, identity, and access management (IAM), intrusion management, Security Information and Event Management (SIEM), vulnerability scanning, and others.

The SIEM is expected to account for the largest segment of the security services market over the forecast period. The popularity of security as a service is growing as small and medium-sized enterprises, and large enterprises are concerned about the security of access to their network, endpoint, cloud, and applications.

The support and maintenance services segment is estimated to gain the largest market share due to the need to solve any technical problems and eliminate or reduce breakdowns.

The SME segment to reach the highest CAGR over the forecast period

The SME segment is expected to grow rapidly due to the rise in cyberattacks. Small and medium businesses are small in relation to their size, but they provide services to a huge number of customers around the world.

Security as a service is in demand in many areas: banking, financial services, and insurance (BFSI); government organizations and defense enterprises; retail; healthcare; IT and telecom; energy and utilities; production and others.

The Retail is forecasted to reach its maximum CAGR.

North America will have the largest security as a service market

The global security as a service market is segmented by region: North America, Europe, APAC, MEA, and Latin America. In 2020, the North American region, followed by Europe, is expected to create the greatest demand for both security as a service solution and service vendors

The increasing popularity of the Internet of Things (IoT), cloud adoption, the ongoing Bring Your Own Device (BYOD) trend, and growing internal and external threats are some of the key factors driving the growth of the security as a service market in North America.

The security-as-a-service market in the APAC region is spinning on as security as a service solutions provide proactive measures to fight off cyberattacks. SMEs, as well as large organizations in the APAC region, have become more aware of cyber threats and cyber risks, thus they got to increase their organizations’ cyber resilience to prevent and counter cyberattacks.

Source: marketsandmarkets.com